Why AD is a prime attack target in the financial industry

As the core identity services for 90% of businesses worldwide including banks and financial services, Active Directory is a primary target for cyberattackers. Semperis protects financial institutions from identity-related cyber incidents before, during, and after an attack. Semperis helps expose blind spots in the organization’s core identity system, detects and autonomously rolls back malicious activity, and ensures a full, malware-free, speedy recovery of business operations.

Here’s how Semperis has helped some of the largest financial institutions recover from AD-related attacks.

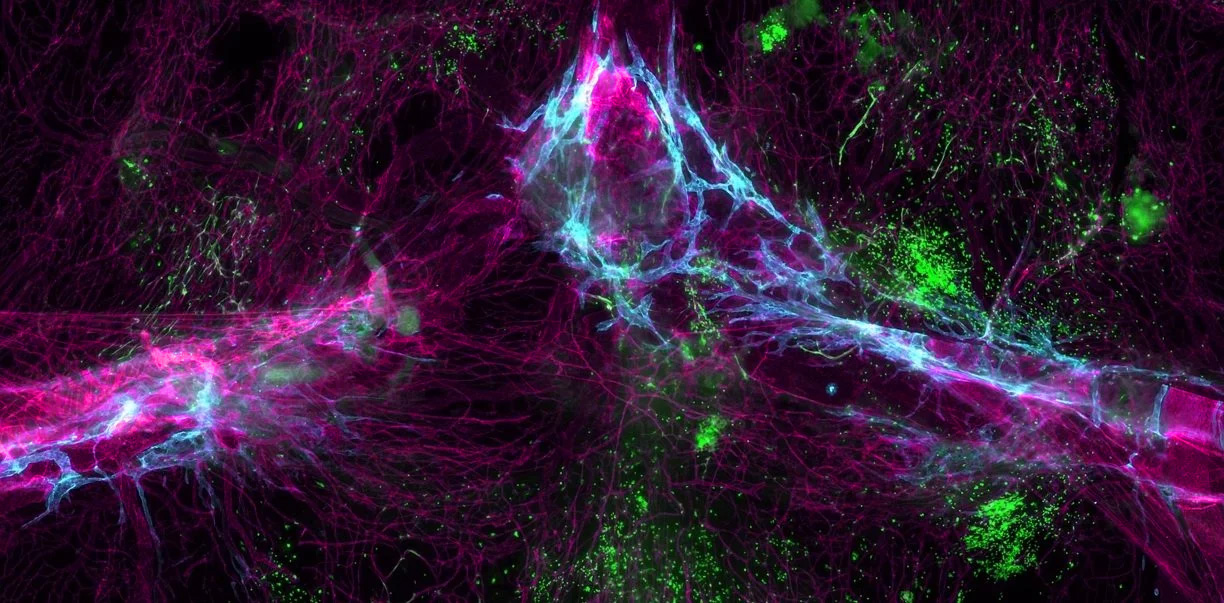

Cyberattacks against banks and other financial companies target security weaknesses in Active Directory to gain access to the organization’s information systems, including customer account information.

Semperis exposes security gaps in Active Directory, including indicators of exposure (such as configurations that have drifted over time) and evidence of malicious activity.

After gaining access to the financial institution’s information systems, attackers can move throughout the network, often undetected, before dropping malware.

Semperis identifies attacks that bypass agent-based or log-based detection, including many SIEM solutions, and provides autonomous rollback of suspicious activity.

Cyberattacks can bring banks, investment firms, and other financial services operations to a halt, preventing access to funds, compromising customer data, and stoking public fear and panic.

Semperis reduces the time to fully recover Active Directory from days or weeks to minutes or hours—accelerating the return of business operations and closing security gaps to prevent a similar attack from reoccurring.